The Central Bank has decided to leave mortgage lending rules unchanged, following its annual review of the measures.

The bank said the measures are achieving the twin objectives of maintaining financial stability and protecting consumers.

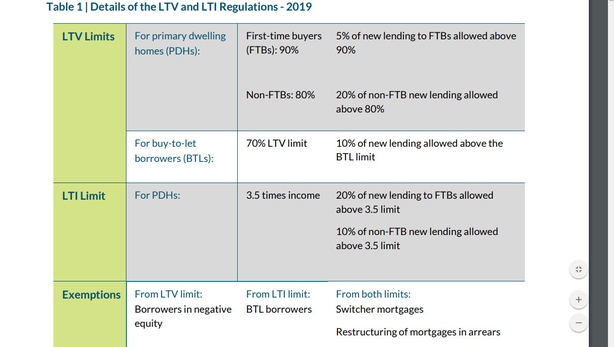

Both the loan to income and loan to value limits will remain unchanged, following today’s decision.

In a statement, the Central Bank bank said the pace of growth in new mortgage lending remains strong.

But it added that the volume of mortgage lending remains below the levels associated with a fully-functioning housing market.

The decision will come as a disappointment to some banks and brokers, who wanted more flexibility in the application of the rules.

In its review, the Central Bank said it had evaluated the systemic risk related to the mortgage and housing markets.

It said that analysis confirms "that the mortgage measures as currently calibrated are achieving the objectives of maintaining financial stability and protecting consumers".

The Central Bank's study also found that that new mortgage lending does not appear to be the most prominent driving factor in house price developments.

Increases in housing supply and turnover should contribute to further moderation in price growth, it stated.

"The mortgage measures support sustainable mortgage lending in the wider housing market, thereby contributing to financial stability and protecting borrowers from excessive debt," Central Bank Governor Philip Lane said in a statement.

"Our review shows that, while the pace of growth in the new mortgage lending is strong, there has been little change in average LTVs and LTIs and no sign of a generalised deterioration in lending standards.

"On the basis of these findings, no change is required to the current framework," Professor Lane said.

We need your consent to load this rte-player contentWe use rte-player to manage extra content that can set cookies on your device and collect data about your activity. Please review their details and accept them to load the content.Manage Preferences

While there is a broad acceptance that the rules are generally good for the stability of the economy, some banks and brokers are understood to be frustrated by the manner in which the rules are applied.

They would like more flexibility, with a system of rolling exemptions, rather than one which ties them to a set cap over a calendar year.

Meanwhile, chief economist at Davy Group, Conall Mac Coille, has said the review of mortgage lending rules is masking the main issue, which he said is the lack of housing.

Speaking on RTÉ's Morning Ireland, Mr Mac Coille said the review is "tinkering at the fringes" and "it's not going to ultimately change the fact that there's a lack of housing supply, hence housing affordability is stretched".

"We could give out as many mortgages as we liked, but it wouldn't change the fact there's a lack of housing," he added.

He added that a sustained and substantial expansion in housing supply is the best solution to the house price inflation problem.

"A fully functioning and sustainable housing market is not achieved by tolerating imprudent lending standards by banks or excessive borrowing by households," he stressed.

Limits were introduced in 2015 which capped how much banks can lend for the purchase of a home relative to its value and the borrowers' income in a bid to curb any repeat of the excessive lending that devastated the economy a decade ago.

The Central Bank said it will continue to monitor developments as part of the annual review of the mortgage measures.

The Banking and Payments Federation Ireland (BPFI) said it noted today's review by the Central Bank.

"Managing and predicting how mortgage approvals translate into actual drawdowns present an on-going challenge to lenders to come within the exemption limits set under the macroprudential measures," said Maurice Crowley, BPFI Acting Chief Executive.

"Consequently, we have previously asked the Central Bank to take into account the operational challenges which lenders face."

While Brokers Ireland said today's announcement was "very disappointing".

The group, which represents 1,250 brokers, said the Central Bank decision will continue to force people into the rental market where there is a yawning gap between repaying a mortgage on a home and paying rent on a similar home.

Rachel McGovern, Director of Financial Services at Brokers Ireland, noted that in some areas renting is almost double the price of servicing a mortgage.

"While it must be acknowledged there is a major issue with the lack of supply of suitable properties, nonetheless, the gap between repaying a mortgage and paying rent for a similar property is stark, with it being substantially more expensive to rent in almost every area of the country, incredibly even allowing for a 2% increase in interest rates," she said.

"These rules by their very severity are most certainly contributing to there being a lost generation stymied in their efforts to begin their financial planning journey with the purchase of a first home, laying solid foundations with the discipline of mortgage repayments and building security for later years," she added.