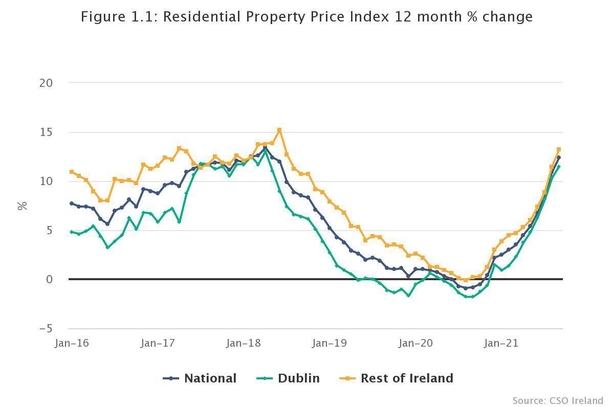

Residential property prices rose by 12.4% in the year to September, according to the latest figures from the Central Statistics Office.

Prices continued to rise at a faster rate outside Dublin, at 13.2%, compared to 11.5% in the Dublin region.

Today's CSO figures show that within Dublin, houses rose by 14.1% in Dublin City while in Fingal they rose by 8.6%.

Prices rose fastest outside Dublin in the Border region, by 21.9%. But even in the slowest growing region - the Mid East - prices rose by 10.7%.

Nationally, prices are now 7.4% below their 2007 peak. Prices have risen 106.5% from their post-crash low point in 2013.

When broken down between new and existing dwellings, the pace of price increases of existing homes almost doubled from the second quarter of this year to the third quarter.

The CSO said the annual rate of increase went from 6.1% between March and June to 13% between July and September. New homes went from 2.2% to 3.3% over the same two quarters.

The price of existing dwellings fell by 1.6% in the third quarter of 2020.

Today's figures also show that the volume of transactions in September was up 14.3% on August and up 34.8% compared to September 2020.

Existing houses accounted for 86% of transactions, an increase of 43.2% over the year while new homes accounted for 14%, more or less flat compared to last year.

The median, or mid-point, price paid for a property nationwide was €272,000. In the Dublin region, this was €400,000.

Within the Dublin region, the highest median price was €570,000 in Dún Laoghaire-Rathdown and the lowest was €368,500 in South Dublin.

Outside Dublin, the highest median price was €375,000 in Wicklow and the lowest was €125,000 in Leitrim.

Today's CSO figures show the Eircode with the highest median price of €672,500 remains A94 Blackrock. The five most expensive Eircodes are all in Dublin.

Outside Dublin, the highest median Eircode also remains A63 Greystones at €495,000.

The lowest priced Eircode outside Dublin was H23 Clones at €80,000.

Ireland has fallen well short of meeting housing demand each year since a property crash more than a decade ago, although supply is beginning to pick up after Covid-19 lockdowns.

Overall, prices are just 7.4% below the credit-fuelled 2007 peak.

Highlighting the recent momentum in growth, Goodbody stockbrokers said that residential prices grew at an annualised pace of 25% in the three months to September, the fastest pace of growth in seven years.

The stockbrokers noted that all regions contributed to the acceleration in house prices over recent months.

It also said that the second-hand market is leading the charge higher, with prices growing by 13% year on year in the third quarter, relative to just 3.3% for new homes.

"In the context of the cost increases now being seen in the construction sector in Ireland, the 3.3% rise in new home prices looks relatively low and would likely imply margin weakness for the building sector generally," Goodbody's chief economist Dermot O'Leary said.