|

Fórsa members get travel insurance discount

Fórsa has used its bargaining strength to negotiate a special discount on travel insurance through KennCo, which offers the union’s members annual multi-trip cover for just €59. The same price applies for individuals, couples or families of Fórsa members.

Get a secure quote here.

If you’re thinking of taking a holiday, consider purchasing your travel insurance through KennCo who have been providing cover to members since 2012. You can have peace of mind for you and your family knowing that you are covered by our annual multi-trip travel insurance.

KennCo travel insurance has a range of great features and benefits including:

- 365-day medical assistance

- Medical and emergency expenses

- Cancellation and curtailment

- Lost baggage

- Public liability

- Missed departure

- Personal accident

- Winter sports and scuba diving included

- Worldwide and European cover

Get a secure quote here.

The importance of travel insurance

You wouldn’t drive your car without motor insurance or leave your home uninsured, so why risk travelling without the necessary cover? Travel insurance is a necessity and should be part of your travel checklist when taking that well deserved break. Passports, tickets, money, insurance!

Why annual multi-trip?

It can be tempting to take out cover each time you take a trip but this can be timely and costly. Plus you run the risk of forgetting to get cover at all. One annual multi-trip policy will cover all trips. Whether you like to follow football or rugby, the odd weekend in a European city, a winter break, a summer holiday, or you take a trip around Ireland with at least one night’s pre-booked accommodation, then annual multi-trip is the right choice.

Cancellation cover

It’s important to have cancellation cover in place once you have booked your trip, if not before. Remember, it’s not just about when you’re on the way to the airport, once you’ve booked your flight or accommodation, you need insurance in place in case you can’t make the trip.

Be confident in your level of cover

KennCo underwriting provides a comprehensive worldwide annual multi-trip product that is competitively priced. This policy covers not only Fórsa members, but also their spouses, partners and unmarried dependent children under 18 years or under 23 years if in full time education. This policy automatically covers everywhere in the world.

Looking for single trip insurance?

You may be planning on having just one single trip this year, but it is still important to have travel insurance. Whether it’s a business meeting or a family holiday, situations may occur were you’re left wishing that you had taken out cover. With prices starting at just €11.22, you can get cover for lost baggage, medical cover or missed departures to name a few.

Don’t forget to purchase travel insurance as soon as you book that trip to avail of cancellation should you be unable to travel.

Terms and conditions apply.

For further information and quotes on our travel product why not give us a call on 01-499-4607 or visit our website.

This information is also available on the Fórsa website.

KennCo Underwriting Ltd T/A KennCo Insurance is regulated by The Central Bank of Ireland. KennCo Underwriting Ltd is a tied agent for Travel Insurance with ERV T/A ETI-International Travel Protection.

|

|

Unions target pay adjustments in 2019

by Diarmaid Mac a Bhaird

ICTU’s private sector committee has set a target of 3.4% for private sector pay settlements in 2019.

ICTU’s private sector committee has set a target of 3.4% for private sector pay settlements in 2019. The committee also said it wants to secure additional benefits and continue to address ‘legacy issues’ in private sector employments.

The 3.4% target is up from a 3.1% ambition it set for this year. Unions say the target takes account of expected inflation in regard to personal consumption, as well as increases in the cost of housing and other necessities.

Additional benefits like improved annual leave, bonus payments, pensions and vouchers, have also been an increasingly common feature of agreements in recent years.

Head of Forsa’s Services and Enterprises Division Angela Kirk, who is a member of the ICTU committee, said the union had reached a number of agreements in the private sector and commercial semi-state bodies this year. These include a 3% basic salary increase in Dublin Airport Authority in a three-year agreement covering 2017-2019.

Angela added that Aer Lingus non-pilot grades agreed an 8.5% deal, to be paid over 39 months from April 2017, with scope for further increases linked to productivity.

Non-commercial semi-state pay to improve

by Bernard Harbor

Staff in non-commercial semi-state organisations are due to receive their next union-negotiated pay and pension levy boosts from 1st January.

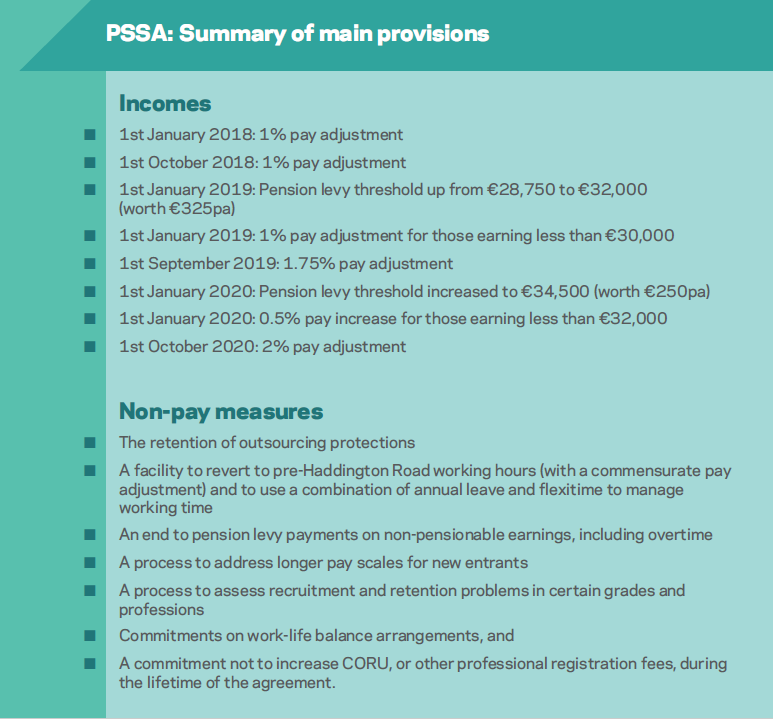

Staff in non-commercial semi-state organisations are due to receive their next union-negotiated pay and pension levy boosts from 1st January. Under the Public Service Stability Agreement (PSSA), pay will go up by 1% for staff earning up to €30,000. The pension levy threshold will also rise to €32,000, bringing a net improvement of €325 a year for most council staff.

The deal, which was negotiated by Fórsa and other unions in 2017, will also deliver another 1.75% salary adjustment in September. Further pay boosts and another adjustment in the pension levy threshold are due next year.

The PSSA was accepted in ballots of the members of the three unions that amalgamated to create Fórsa earlier this year. It will also see an end to the pension levy on any non-pensionable elements of public service incomes from January 2019.

Earlier this year, the union also insisted on early measures to address the ‘new entrants’ pay issue even though, under the agreement, this was not bound to be dealt with until 2020 at the earliest.

Non-pay provisions in the PSSA include strong protections against outsourcing.

Public servants benefit from pension levy changes

by Bernard Harbor

Three significant changes to the public service ‘additional superannuation contribution,’ which replaced the so-called pension levy under the Public Service Stability Agreement, come into force on 1st January.

Three significant changes to the public service ‘additional superannuation contribution,’ which replaced the so-called pension levy under the Public Service Stability Agreement, come into force on 1st January.

First, the threshold for paying the levy will rise to €32,000, bringing a net improvement of €325 a year for most civil and public servants. Those who currently earn less than €30,000 a year, who do not benefit from this change, will instead get a 1% pay increase next month.

Secondly, there’s a further boost for those who joined the public service after January 2013 and who are in the single public service pension scheme, which was introduced at that time. They will now pay only two-thirds of the additional contribution rate – a figure that will fall to one-third next year.

This reflects the fact that the benefits of the single scheme are different from those in the older scheme.

Thirdly, the contribution will no longer be payable on any non-pensionable elements of public service incomes from January 2019.

All of these changes are contained in the current public service pay agreement, which was negotiated by Fórsa and other unions in 2017. That deal will also see a 1.75% salary adjustment for all civil and public servants next September.

Further pay boosts and another adjustment in the ‘additional superannuation contribution’ threshold are due next year.

The PSSA was accepted in ballots of the members of the three unions that amalgamated to create Fórsa earlier this year.

Survey highlights benefits of being retired Fórsa member

by Diarmaid Mac a Bhaird

A survey of 590 Fórsa members over the age 60 has highlighted the benefits of being a retired Fórsa member.

A survey of 590 Fórsa members over the age 60 has highlighted the benefits of being a retired Fórsa member. Almost two-thirds (62.2%) of respondents said they intended to continue their Fórsa membership after retirement.

The email survey was distributed to Fórsa members over the age of 60.

Fórsa official Joe O’Connor says that the findings of the survey are positive, but that there was work to do to improve awareness of the benefits of being a retired member.

“Keeping involved in the union’s work, in addition to campaigning and social engagements, were central to so many people retaining their membership after retirement. Retirement is a time when people’s lives change and remaining involved with the union appears an attractive option for people who are at that stage,” he said.

Joe said there is scope to increase the number of retired members, and that a recruitment drive would facilitate making improvements to current benefits and adding new ones.

Respondents to the survey said they would be interested in increased services, such as access to a pension’s consultant, financial advice and pre-retirement planning courses or seminars.

Other suggestions included providing information on budgetary and legislative changes relevant to retired members and an increased number of services especially dedicated to retired members.

Joe said the next step is to make use of the survey’s findings. “Just over a third of respondents expressed an interest in participating in further research to consider the current working of the programme, so that could be the next phase of the project.”

Congress welcomes disability threshold rise

by Bernard Harbor

The Irish Congress of Trade Unions (ICTU) has welcomed a significant increase in the amount of money people with disabilities can earn before they lose their medical card.

The Irish Congress of Trade Unions (ICTU) has welcomed a significant increase in the amount of money people with disabilities can earn before they lose their medical card.

The Government recently announced that the so-called ‘income disregard’ would rise from €6,000 a year to €22,000. ICTU called this a “significant development in removing barriers to employment for people with disabilities.”

Unions believe the change, which is in line with a recommendation in the 2017 inter-departmental report ‘Make Work Pay,’ will remove the fear of losing a medical card for many people with disabilities who want to work.

People with disabilities are currently only half as likely to be in employment as other people of working age.

Hopes for law on pension age

by Bernard Harbor

There is renewed hope that the Oireachtas will pass legislation allowing public servants to retire after age 65 before the Christmas recess.

There is renewed hope that the Oireachtas will pass legislation allowing public servants to retire after age 65 before the Christmas recess.

This avoids more staff suffering a huge gap in retirement income when forced to leave work a year before they reach the new state pension age of 66. It follows earlier fears that the legislation would be delayed until next year.

Earlier this year the administration bowed to union pressure and agreed to legislate to give civil and public servants the option to retire at any age between 65 and 70 if they chose.

This was necessary because many civil and public servants depend on the state pension for a substantial part of their retirement income, but they are currently required to retire a year before that’s available.

Interim measures, which allow them to be re-hired until age 66, are unpopular as they treat staff as is they were newly employed. This also means a significant drop in income, even though they are still working.

The new legislation went to committee stage in the second week of December.

A Fórsa spokesperson said: “This issue has had a massive impact on the individuals who are caught offside by the current legal retirement to retire at age 65 or, in some cases, before.

“Each day that passes sees more workers forced to retire and immediately sign on for unemployment benefit because a large proportion of their pension is made up of the State old age pension.

“Most TDs and senators understand the urgency of the situation, but Fórsa would urge them, once again, to get this legislation on the statute book quickly.”

|

|

Season’s greetings to all our readers

by Róisín McKane

As the first year of Fórsa draws to a close, it’s a good time to reflect on the year we’ve had. Our new union - 80,000 members strong - has achieved a lot since January, and is already facing injustice head on, in the workplace and in our communities.

Fórsa has shown it’s a force to be reckoned with.

As we sign off on our final bulletin of 2018, a special word of acknowledgement and thanks goes out to the many Fórsa members who will be working or on-call, maintaining vital public services over the Christmas period.

And we wish all our members a wonderful Christmas and a very happy and healthy New Year.

Have a good break. The news bulletin will return in January.

Minimum wage reduced gender gap

by Diarmaid Mac a Bhaird

|

The introduction of the statutory minimum wage reduced the gender pay gap for lower-paid workers in Ireland, but did not affect the wage gap at any other salary levels, according to a new report from the Economic and Social Research Institute (ESRI).

The study Minimum wages and the gender gap in pay, examines how the gender wage gap changed following the introduction of the minimum wage in Ireland in 2000 and in the UK a year earlier.

The report says the positive impact on the gender pay gap at lower income levels happened because women are more likely than men to work in low paid jobs. It found that salaries of the lowest payed men was 24% higher than the lowest payed women prior to the introduction of minimum pay. This dropped to 5% after it was introduced.

The introduction of the minimum wage in the UK didn’t have the same impact on gender pay differences because of different patterns of compliance.

Co-author of the study Karina Doorley said: “In the UK, most of those earning less than the minimum wage after its introduction were women while in Ireland, men and women were equally likely to experience minimum wage non-compliance.”

Limerick Soviet centenary publication: submissions sought

by Niall Shanahan

|

The Limerick Writer’ Centre propose to publish an anthology of writings and artistic material in conjunction with the Limerick Soviet 100 Committee’s special celebrations of the 100th anniversary of the Limerick Soviet.

Fórsa members are invited to submit material for the publication, illustrating on their thoughts on the 1919 Soviet and/or its legacy for Ireland in 2019.

The Limerick Soviet was a self-declared soviet that existed from 15th to 27th April 1919.

A general strike was organised by the Limerick Trades and Labour Council, as a protest against the British Army's declaration of a "Special Military Area" under the Defence of the Realm Act, which covered most of Limerick city and a part of the county. The soviet ran the city for the period, printed its own money and organised the supply of food.

The event made world, as well as national headlines, at the time, and is still seen, internationally, as a major occurrence in labour history.

Local and national figures will be invited to contribute to the publication. It will be edited by Dominic Taylor and John Liddy and published by The Limerick Writers' Centre in 2019, the centenary year.

Submissions should be made to the Limerick Writer Centre, 12 Barrington Street, Limerick, Ireland (limerickwriterscentre@gmail.com) by 28th February 2019.

Centenary – An anthology celebrating the Limerick Soviet 1919 is due to be published no later than October 2019.

Court defeat for Deliveroo riders

by Diarmaid Mac a Bhaird

Deliveroo riders in Britain have lost a high court battle for union recognition. The ruling upholds a previous decision that the riders are self-employed, rather than employees of the company.

The outcome is seen as a setback to trade unions and other campaigners who are seeking to protect workers’ rights and introduce basic benefits like annual leave and sick leave in the ‘gig economy’.

The Independent Workers Union of Great Britain had argued that the company’s refusal to engage in collective bargaining breached the rights of Deliveroo riders under the European convention on human rights. But the court ruled that the riders were not in an ‘employment relationship’ in the context of European human rights law.

|

|

|